General information

Software Introduction

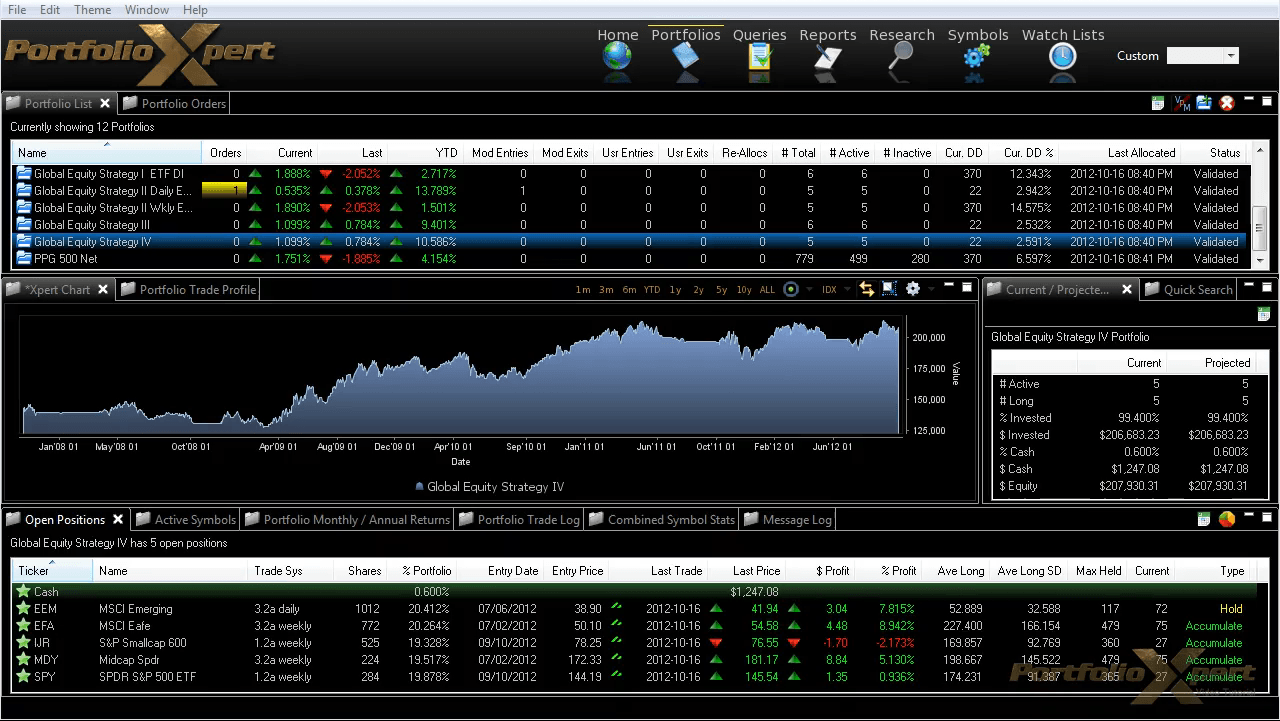

VIEWS

VIEW BREAKDOWN

- Portfolio Rolling 12 Month Returns

- Portfolio Rolling 24 Month Returns

- Long Positions Breakdown Chart

- Active Symbols

- Current / Projected Positions

- Open Positions

- Portfolio List

- Monthly / Annual Returns

- Portfolio Orders

- Portfolio Symbol Returns

- Portfolio Trade Log

- Portfolio Trade Profile

- Combined Symbol Stats

- Fundamental Snapshot

- Quick Search

- Research

- Symbol History

- Symbol Model Results

- Symbol Stats History

- Symbol Trade Log

- Symbol Trade Profile

- Trend / Resistance / Support

- Queries

- Reports

- Watch List Triggers

- Watch Lists

PERSPECTIVES

PORTFOLIO

QUERY

WATCH LIST

What is PortfolioXpert?

PortfolioXpert is a dynamic platform that can model virtually any investment strategy utilized in the asset management industry. Driven by an artificial intelligence engine it uses parametric analysis, with over 600 rules, in a database of 17 thousand 600+ symbols calculating over 10 million 5 hundred variables to determine buy and sell points.

This combined with the dynamic allocation process allows Portfolio expert’s artificial intelligence to adapt to market conditions, by increasing exposure during positive market trends and reducing exposure during risky market environments, therefore, delivering an accurate risk-adjusted return to your clients!

Portfolio Designer

Our portfolio designer allows you to build back-test and walk forward your strategies giving you unparalleled confidence.

Our Portfolio wizard step by step process walks you through the building of a fully adaptive strategy, delivering in minutes, a complete-back-test, including returns, relative risk metrics, and more.

Customized Portfolios

Your firm can also offer customized portfolios or a Dynamic Direct Index’s for High net worth elite clients. This empowers you to provide products and strategies previously only available to the multi-billion-dollar managers.

With over twenty years, of providing consulting and process-driven portfolios to the advisory community, we have built a selection of models to choose from as deploying these will accelerate the implementation of the adaptive process in your practice.

The platform also can model tactical portfolios utilizing the PortfolioXpert signals or any signals you have access to.

It also models customized (MPT) Modern Portfolio Theory, or allocation strategies with the ability to automate re-balancing points based upon the Advisers input.

You customize the platform, you determine position allocation, purchase and sales points, and set your re-balancing, that is fully automated. All trades can easily be exported to multiple custodians giving you the ability which to scale your practice.

Also, the ability to private label Portfolio expert further places you at the forefront of your value proposition, therefore demonstrating to your clients your depth of understanding of the money management process.

Xpert Research Platform

The portfolio expert research platform provides complete transparency, on all 17 thousand 600+ symbols as you can view comprehensive metrics on every symbol, including every trade issued, and use our proprietary evaluation algorithm to validate the symbols before you use them in a strategy.

Also, you can build watchlist and develop sophisticated queries, allowing you to dig deep into the platform’s vast database!

Its unique capability of being able to issue decisions on each symbol is key to delivering its highly adaptive approach to volatility.

Dynamic Approach

With most firms having grown up in a neoclassical financial paradigm our platform allows you to breakout of that thought process, enabling you to deliver a dynamic and adaptive approach to your clients.

PortfolioXpert gives you the ability to protect your clients and your business against catastrophic risk, while delivering risk-adjusted returns over a multi-year investment cycle.

Our Platform gives you the peace of mind of knowing that you have an insurance policy, while still creating Alpha during positive market trends

The portfolio expert’s artificial intelligence engine has been validated over 21 years of real-world implementation and has managed over $275 billion.

The value that can be built from an investment and a practice perspective cannot be underestimated. This product has helped thousands of advisory firms to offer products and scale their business, like they never dreamed they could.

The Platform offers daily PDF reports, and fully customized fact sheets on your primary strategies giving your firm the look and feel of a major institution or mutual fund company.

Our simple on-boarding and implementation process, enables advisory firms to bring in these new adaptive strategies into their firm within weeks of deciding to use portfolio expert

- TABLE OF CONTENTS