General information

Software Introduction

VIEWS

VIEW BREAKDOWN

- Portfolio Rolling 12 Month Returns

- Portfolio Rolling 24 Month Returns

- Long Positions Breakdown Chart

- Active Symbols

- Current / Projected Positions

- Open Positions

- Portfolio List

- Monthly / Annual Returns

- Portfolio Orders

- Portfolio Symbol Returns

- Portfolio Trade Log

- Portfolio Trade Profile

- Combined Symbol Stats

- Fundamental Snapshot

- Quick Search

- Research

- Symbol History

- Symbol Model Results

- Symbol Stats History

- Symbol Trade Log

- Symbol Trade Profile

- Trend / Resistance / Support

- Queries

- Reports

- Watch List Triggers

- Watch Lists

PERSPECTIVES

PORTFOLIO

QUERY

WATCH LIST

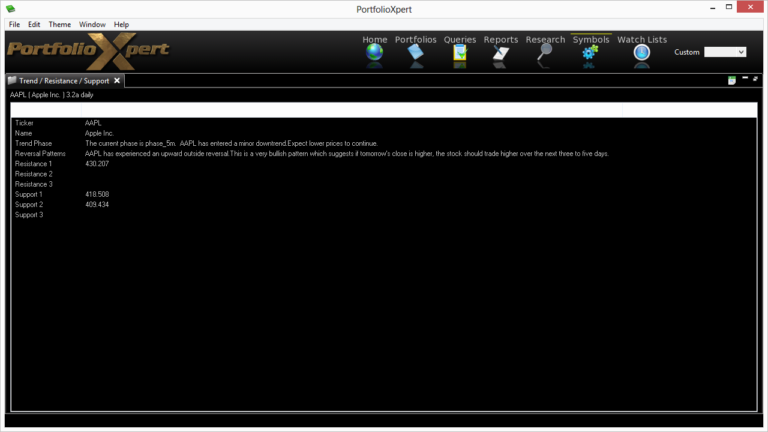

Trend / Resistance / Support

The Trend/Resistance/Support view displays the current trend phase and the resistance and support prices for a selected security.

View Tab

- Double click the view tab to maximize the view full screen. Double click it again to restore.

- Right mouse click on the view tab to open the view popup menu.

- Click

- in the view tab to close the Trend/Resistance/Support view.

- Left mouse click the view tab and hold down the mouse button to move the Trend/Resistance/Support view. Release the mouse button to place it.

View Toolbar

The View Toolbar contains controls and settings specific to the Trend/Resistance/Support view. Mouse hover over a button to see its tooltip.

Table to Spreadsheet button

- Click

- to export the Trend/Resistance/Support table to a spreadsheet (sorting applied prior to exporting will be preserved in the spreadsheet).

Information Displayed

- Ticker – security ticker symbol

- Name – security name

- Trend Phase – summary of the trading system/model’s current view of the security and expectation going forward (phases are numbered 1 thru 5)

- Reversal Patterns – summary of the reversal patterns experienced by the security (if applicable)

- Resistance 1 – first expected resistance price based on some technical and quantitative indicators (depending on the current trend one or more resistance prices could be absent)

- Resistance 2 – second expected resistance price based on some technical and quantitative indicators (depending on the current trend one or more resistance prices could be absent)

- Resistance 3 – third expected resistance price based on some technical and quantitative indicators (depending on the current trend one or more resistance prices could be absent)

- Support 1 – first expected support price based on some technical and quantitative indicators (depending on the current trend one or more support prices could be absent)

- Support 2 – second expected support price based on some technical and quantitative indicators (depending on the current trend one or more support prices could be absent)

- Support 3 – third expected support price based on some technical and quantitative indicators (depending on the current trend one or more support prices could be absent)